For prepared investors, market downturns can represent great opportunity

Nearly everywhere you turn, from friends and colleagues to cable news shows, you can find someone with a strong opinion about the financial markets. People will often use specific terms such as bear market to render judgments about the direction of markets, especially when market performance is choppy or trending down.

Is it worth getting concerned when markets stop or even reverse their upward advance?

To answer that, it’s important to realize that downturns are not rare events: Typical investors, in all markets, endure many of them during their lifetimes.

Even knowing this, it can be unsettling to witness the decline of your portfolio during one of these events. After all, that account balance is more than a number—it represents very important personal goals, such as the ability to retire comfortably or to provide a quality education for family members. When market conditions jeopardize those goals, you may feel compelled to do something, such as sell most of or all your investments. You may assume that converting to cash will give you a better long-term result than staying invested.

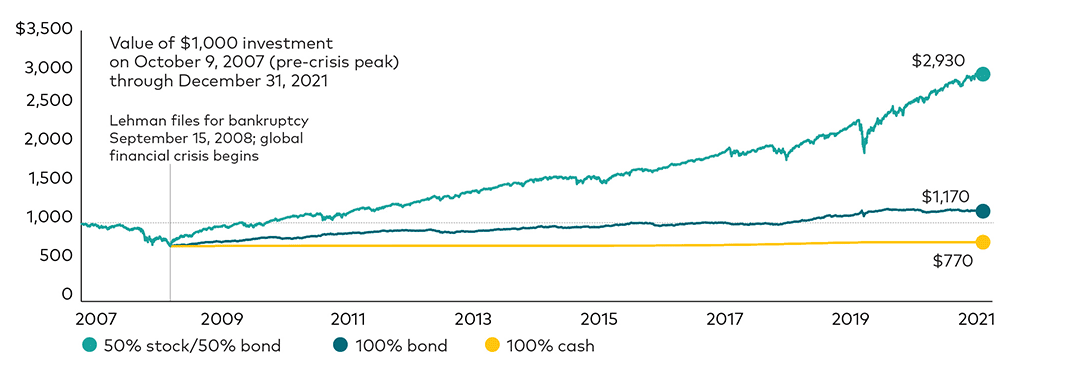

But such action would shut you out of the strong recoveries that have historically followed market downturns. The answer is to come up with a game plan before the next market pullback so you’re well-positioned to try to take advantage of the opportunities that follow. What’s more, you’ll probably know what to expect as markets cycle through their phases, so you can tune out messages that don’t help

your strategy.

It’s worth noting that not all financial declines are the same in length or severity—for example, historically speaking, the global financial crisis of 2008–2009 was an extreme anomaly. As challenging as that event was, it was followed by the longest stock market recovery in U.S. history.1

Since 1980 there have been:

|

|

Source: Vanguard.

Notes: Number of bear markets based on MSCI World Index from January 1, 1980, through December 31, 1987, and the MSCI AC World Index (price return) from January 1, 1988, through December 31, 2021. Number of recessions based on the National Bureau of Economic Research’s US Business Cycle Expansions and Contractions data.

Sources: Vanguard calculations, using data from FactSet. All data as of December 31, 2021.

Notes: This is a hypothetical illustration. The Balanced portfolio is represented by 50% S&P 500 Index and 50% Bloomberg U.S. Aggregate Bond Index; bonds are represented by Bloomberg U.S. Aggregate Bond Index; and cash is represented by 3-month Treasury bills. Past performance is no guarantee of future results. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Riding out a rough period

Best defense: Making a plan and sticking to it

We can develop a plan now that prepares you and your portfolio for financial system shocks, whenever they happen to occur. That means focusing on the factors of your investing strategy we can control (including things such as asset allocation and costs) and not worrying about those things out of our control, such as downturns in the markets and economy.

In the meantime, remember that bearish market conditions—while inevitable—don’t last forever. As a savvy investor, you can ignore short-term pullbacks of the market (and any commentary that might cause you to veer off course) and remain committed to achieving your long-term vision.

Downturns come and go. The results of a well-designed and faithfully followed plan, on the other hand, can serve you the rest of your life.

In coming up with the best plan for you, it is helpful for you to think about the following:

• How do you feel about risk? Are you okay with a greater amount of up-and-down movement in your portfolio if it means potentially higher returns? Or, alternatively, would you rather have more stability in your portfolio even if it means forgoing higher returns?

• Where are you along your investing journey? Depending on how close you are to retirement or other financial goals, we can adjust your portfolio’s risk profile to a level appropriate for your personal risk-comfort level and investing objectives.